50 On Up - NEXT-GEN PLANNING

What really works and (what doesn't)

in mid-life planning today

From tailored strategies to ready-to-use tools, we’ll help you cut through the overwhelm and build a plan for your future that creates life on your terms - before your dreams quietly slip away.

How ready are you for what comes next?

FIND OUT YOUR PLANNING BLIND SPOTS

— It's free. 5-mins

NO SPAM. No pressure.

Do you want freedom and the life you worked hard for?

But right now - does It feel unclear, overwhelming, or even a little out of reach?

We Get It we've been there too: Our Retirement Plan Was Disrupted

We'd worked hard, saved wisely, protected our health and genuinely felt on track to retire early in our 60s, on our terms.

Then life shifted the goalposts. We weren't prepared when our turning point found us.

Our story (2 min)

What About You

Do any of these scenario's reflect your Over 50 life story right now?

Maybe You're: Not Feeling Any Changes Yet

But sensing a turning point ahead?

Life looks “fine” on the surface, but you’re still carrying the responsibilities of a typical 40-year-old’?

“Over 60% of adults over 50 experience a major life disruption (health, work, or family) within a 5-year window of turning 50— usually without warning.”

Source: AARP / Merrill Lynch

Maybe You're: Unable Retire Anytime Soon

And have too many people depending on you?

You are watching AI and layoffs reshaping everything, and considering your options moving forward.

“Nearly 56% of workers over 50 are pushed out of their jobs earlier than planned — and only 1 in 10 ever earns as much again.”

Source: ProPublica / Urban Institute

Maybe You've: Hit Your Savings Number…

But now it Feels Too Little?

You saved what you were advised to — yet inflation, rising health costs, and shifting policies have made “enough” feel less certain than ever.

“Inflation and longer lives mean the average retiree now needs 20–30% more than what was considered ‘enough’ just 5 years ago.”

Source: AARP / WEF / Forbes Retirement

Maybe You: Could Have Retired Years Ago…

But Choose Not To?

For many high achievers, the real reason isn’t money — it’s identity, purpose, — fear of losing momentum, status or connection.

“High earners delay retirement for reasons other than money — yet later report the #1 regret is ‘waiting too long to reclaim my time.’”

Source: AARP / Merrill Lynch

All of these scenarios are exactly why navigating mid-life today takes more than a financial plan with a side order of meaning — it takes a framework to design a life you can genuinely feel excited to step into, built for 2026 and beyond.

Ask yourself, is your retirement plan fit for 2026 ?

If navigating life after 50 feels different to what you thought,

it is... you’re not imagining it.

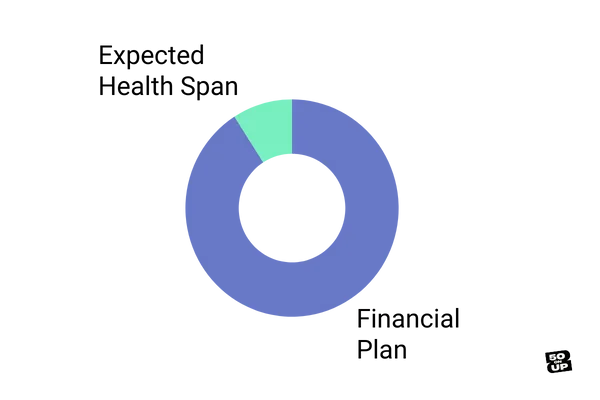

Old-Gen retirement planning model

Built for a different era

For many people today, this model quietly breaks down.

It doesn’t account for identity shifts, responsibility creep, changing energy levels, disrupted careers, or the reality that your vital years may not line up with traditional retirement timing.

Old-generation retirement planning focused almost entirely on money — with the assumption that if the numbers worked, the rest of life would fall neatly into place.

It was designed for a time when:

Work was more stable and predictable

Pensions and property did the heavy lifting

Healthspan closely matched lifespan

Retirement followed a neat, linear path

When life changes, AN OLD-GEN REtirement plan often can’t keep up.

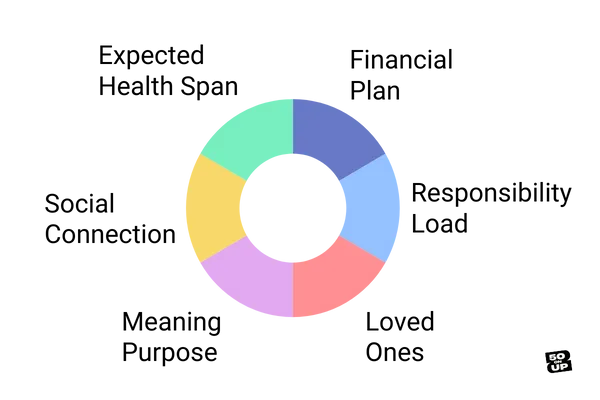

Next-Gen life-planning model

Built for real life, now

It’s about designing a next chapter that actually fits the life you want — while you’re still well enough to live it.

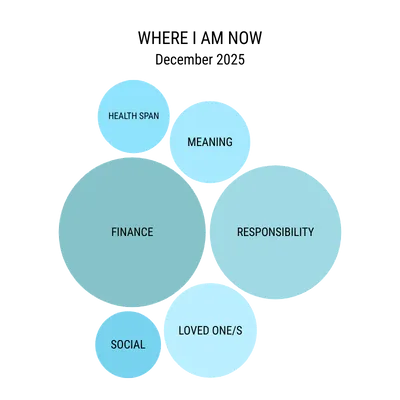

Instead of considering finance in isolation with a financial planner, you get to balance all your life domains and prioritise what comes next on your terms, before life throws curved balls. You choose the balance and priorities for the life you really want.

Finance

Health Span and Longevity

Responsibility

Meaning freedom and flexibility

Relationships with time, energy

Social connection

When life changes, the plan adapts with it.

Why the Old-Gen Model is too risky

When life changes unexpectedly, decisions are made under pressure.

And complex decisions made under pressure often create compromises

Staying in a demanding role vs. protecting your health and energy.

Supporting adult children or ageing parents vs. using your time while you still can

Holding onto the family home vs. unlocking flexibility and future income

Weighing Up Trade-Offs Isn't Wrong or Selfish.

The risk is being forced into them without clarity.

Miss just one blindspot, and it can quietly ripple through everything — your health, money, relationships, meaning, and responsibilities.

Want to understand why one blindspot affects everything? Watch the 3-minute explainer.

Why wait for a turning point to force your hand?

What if you could get clear on what you really want next

— before pressure, health, money, or responsibility decide for you?

This is about creating a real-world plan designed around your life as it is now — and aligning it with where you want it to go next.

Life after 50 is complex.

Your plan doesn’t have to be.

Start Where You Are. Go As Deep As You Need.

You don’t need to figure everything out at once.

We help you build clarity in layers — starting with what matters most right now.

First, you get oriented.

We help you see where you really stand across money, health, responsibilities, meaning, and connection — not in isolation, but together.

Then, you explore your options — safely.

Whether you’re thinking about slowing down, changing work, spending differently, or even living elsewhere, you can explore possibilities without having to commit too early.

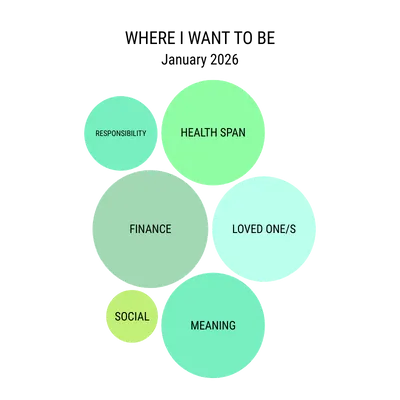

Finally, you design a path that fits you.

Not someone else’s version of retirement — but a realistic next chapter that matches your energy, values, and life constraints.

You stay in control the whole way.

No pressure. No forced decisions. No “one right answer.”

One System. One Path.

Made for your life

One integrated system that helps you:

see where you are now

understand what matters most to you

and move forward with confidence, one step at a time

No overwhelm. No jargon. No pressure.

01 — Scan For Your

Future-Planning Blindspots.

It's free!

This quick scan shows you where you’re strong, where you’re stretched, and what needs attention first.

Find Out Your Planning Blindspots

— It's free. 5-mins

NO SPAM. No pressure.

02 — Optional tweak (clearer payoff):

02 — Dive Deeper

Design the life you want — with clarity

This guided discovery helps you see clearly where you stand across six key life domains — and what to do next.

Set Your Life Balance Alignment Goals

Map out a simple, grounded next-chapter plan outline

Receive highly personalised insights and guidance

Access a bonus group live mini-workshops with the founders for each life domain

Ask questions : Get answers in a live weekly Q&A

Designed for late-Boomer and Gen-X mid-lifers navigating real-world change.

7-Day Jump Start — $79

A guided reset to help you make confident next-chapter decisions — without pressure or overwhelm.

Instant. Private.

What happens next is up to you.

Some people start with money.

Others with health, work, or meaning.

There’s no single right order — just the place that matters most for you.

You don’t have to do everything — just start somewhere.

Get Your Financial Moves In Order

Reveal Your Spending Patterns - Tame Your Budget -

See the unconscious habits that shape your financial decisions, and learn how to realign them with the life you want.

Couples and Solo versions available

Find Your Best-Fit Lifestyle or Location

If your funds don’t stretch far enough, we show you how to explore places where your money — and your vitality — goes further.

Discover Your Retirement Archetype

Uncover the style of retirement (or semi-retirement) you’re actually wired for — so decisions feel natural, not forced. And discover potential ideas you may never have heard of but deliver fulfilment in spades.

Increase Your Health Span Years

Get to know your Current Estimated Health Span and add more high-energy years with simple, science-backed habits.

Expert Partnered Mini-Course

10x Your Happiness As You Age

(regardless of your finances and body aches)

Happiness experts have debunked the link between money and happiness. Build a science-backed, tool box of life enriching exercises that match your personality.

Find People on The Same Page

Grow your Options ideas,

and get your questions answered in a private group with the founders

Early Feedback from Real Users

These reflections come from early users who reviewed the site during its initial release.

“This gave me a roadmap to re-focus on what matters most.” “I knew I was slowing down, but I didn’t realize how much my daily choices were cutting into my healthy years. The Check Up helped me see small shifts I could make straight away—and gave me the motivation to get moving again.”

“We discovered completely different priorities.” “My partner and I took the Check Up separately, and comparing results sparked the best conversation we’ve had in years. It showed us where we’re aligned—and where we need to plan together.”

“It wasn’t money holding me back — it was flexibility.” “I thought my finances were fine, but the Snapshot showed me I was relying too much on one income source. That wake-up call pushed me to diversify—and now I feel more secure about the years ahead.”

No blogs found

Copyright 2025. 50 On Up. All Rights Reserved.